This past year has been unlike any other in our lifetime. The year started out fairly normal but quickly evolved in a Covid-19 lockdown that has rocked the commercial real estate market. Businesses were required to work from home, restaurants were closed and only essential services were open from March through June. The net result was Minneapolis and St. Paul unemployment peaked at 10.1% in May but rebounded to 4.5% by year end.

Office Market

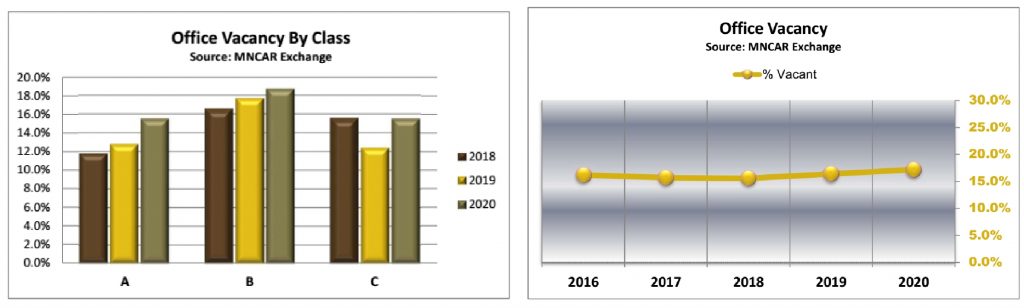

In 2020, approximately 20% of employees worked from their office and 80% worked from home. Companies are rethinking the paradigm of requiring employees to come to the office which may impact the office market for years to come. Office market leasing volume was 25% of what it was in 2019 and demand is expected to remain weak in 2021. Most of the leasing activity involved short term renewals, subleases, and a flight to quality. Lease rates have remained fairly flat but are anticipated to soften as demand remains weak. However, with an average lease terms in the 5 to 7 year range, it will take some time for tenants to give space back to landlords, so a rise in sublease space will continue. The leading sectors for leasing activity were Legal followed by Technology and then Business Services. Overall, vacancy rates in the office market increased from 15.4% to 17.2% and sales activity was about half of the 10 year average. Employers continue to monitor the downtown markets due to concerns over Covid-19 and safety as well as the return of mass transit and other amenities and services.

The rollout of the vaccine in 2021 will determine when tenants will return back to the office. By most accounts, tenants will begin returning to the office in the 3rd or 4th quarter. Employers will continue to wrestle with how much space they need and if the configuration should look different. Leasing activity should be higher in the second half of the year than the first half and lease rates should come down and concessions increase. The good news is that tenant improvements costs are trending downward.

Industrial Market

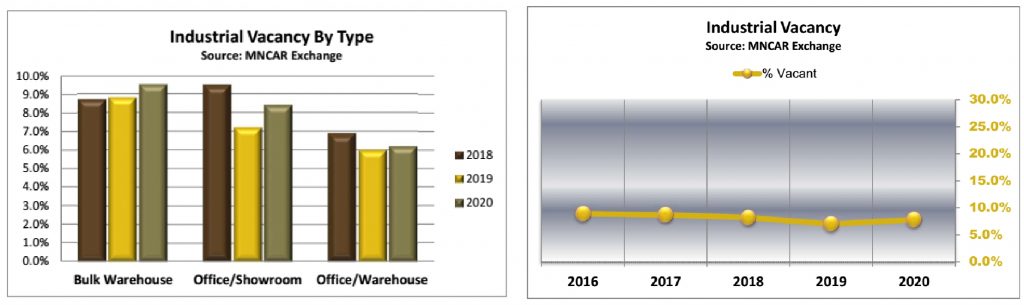

The industrial market continues to be the most resilient sector of the commercial real estate market. The primary drivers are e-commerce retailing and last mile distribution. As the pandemic restrictions were put in place in the second quarter of 2020 e-commerce filled the void caused by the closing of retail stores. In the second half of the year new leasing activity grew over 20% from the previous year while lease rates and concessions remained steady.

The Twin Cities has benefited from its strength in Life Sciences during the Coronavirus and as the population ages. Vacancy rates increased only slightly year-over-year from 7.0% to 7.8%. Construction was up significantly from 2019 and with one-fifth of current properties fully leased it is expected that developers and contractors will be busy in 2021. We anticipate new construction to be particularly strong in the northwest market this year.